India pharma is touted as a big success, but what it does is not much better than Indian IT – low cost work with negligible innovation. There is no simply appetite for pharma R&D in India – not amongst companies, and perhaps as a corollary, not amongst VCs either.

At Wisdomsmith we took on fund raising mandates for 2 R&D firms in the last one year (Wisdomsmith Advisors’ main sector of focus is pharma/healthcare). One was looking for seed funding, and the other for Series A. While we could find and investor for the seed one (strategic), the Series A one has been a struggle. None of the pharma focussed VC funds we talked to, are currently investing in pure play R&D companies.

This despite our firm belief that our client could emerge as the most exciting pharma R&D company in India. This company is doing some globally cutting edge work, has a brilliant business model, and is close to a major breakthrough. It has raised seed funding, has got several government R&D grants, has shown incredible progress from meagre funding, but when it comes to Series A, no takers.

We then talked to several US based biotech funds we know. They said – “great company, but we can’t invest in India. No focus on India”. In other words, if you are a US based biotech VC, India is not on your horizon. And mind you, there are maybe 30 such funds in the US, focussed ONLY on pharma/biotech deals, quite willing to back early stage companies. But not one of them is looking at India.

The purpose of this post is not to rant. I wanted to present some data to show how bad the situation is – the vast chasm in funding ability of a pure play R&D biotech in India (basically zero), versus the US.

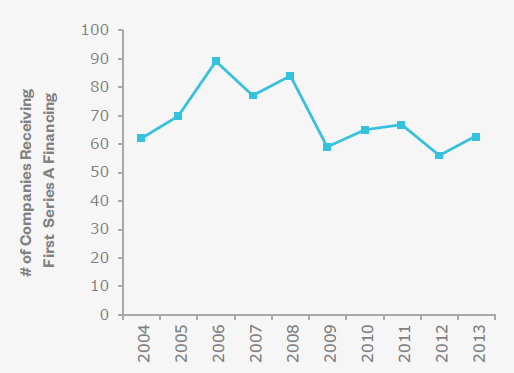

Check the chart below. The 10 year data below shows that atleast 60 pharma/biotech startups get Series A funding EVERY YEAR in the US. In India, how many got last year – NONE. Over 700 (747 to be precise) starts-ups got Series A funding in the US over the last 10 years. How many in India? Maybe 10.

(And this is just Series A. Total deal count in this period is ~2000, some of which would be follow-on. In India, all rounds put together may not cross even 20)

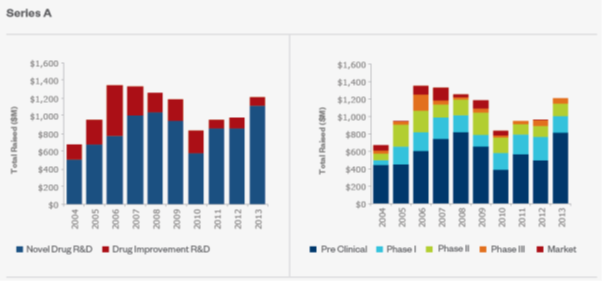

And where does the Series A money go? As can be seen from the chart on the left, mostly for new drug discovery (~82%), not for ‘Drug Improvement R&D’. Annually, over USD 1B. In contrast, in India, VC funds have invested maybe around USD50m in 10 years in backing R&D firms.

The chart on the right further shows the risk taking ability in the US. More than half the money goes into pre-clinical stage companies. In India?…well, let’s not talk about it.

Will this change? Quite unlikely, in the foreseeable future. Unless we have something like-

- The Government allocates say USD 250m per annum for VC investments in pure-play pharma/biotech R&D firms, gives it to say 5 funds like ICICI, Kotak etc; they invest on a purely commercial basis

- Pharma promoters like say those of Sun/Lupin/Zydus etc set up funds to back third party pure-play R&D companies. While they may have burnt money inside their companies, that does not mean they will lose in a VC like set up. Perhaps doing R&D internally was a wrong idea in the first place.

- It could also be a combination of the 2. Government can match $ for $ money deployed by privately set up VC funds.